When you hear about The Fed changing interest rates (again), do you know what that means? Or how it affects you? It’s been a near-constant news topic over the past few years, especially, but the “why” and “what this means for me” in interest rate fluctuations don’t always feel clear. So, let’s talk about it.

It’s a worthwhile topic to dig into, since interest rates affect our financial lives in multiple ways, whether we’re borrowing money, saving it or investing it.

What are interest rates?

Broadly, you can compare interest rates to the cost of borrowing money (or the profit a lender earns from lending money). But more specifically, when people talk about interest rate hikes, they usually mean the federal funds rate — which the U.S. Federal Reserve (The Fed) manages, and which influences rates you see from community banks and other lenders on anything from mortgage loans to car loans.

Lots of things affect interest rates, from the overall state of the economy to prices of goods and services, to consumer spending habits and government policy changes.

How interest rates and the economy intersect

Interest rates and the economy are pretty much glued to each other. When the economy is growing and doing well, The Fed tends to raise interest rates. The aim is to stabilize prices and keep inflation under control. When the economy starts to sputter, interest rates often go down. The point there is to encourage people to borrow and spend, which may give the economy a boost.

How interest rate changes affect borrowers

If you’re thinking about taking out a loan to buy a house or a car, the current interest rates matter a lot. Low interest rates mean it costs you less to borrow money, which makes that loan (and that purchase) more manageable. When interest rates are high, borrowing becomes more expensive. Borrowers who have stable income and a stellar credit history may qualify for lower interest rates on the scale, but the floor — how low current rates will go — pretty much comes down to that federal funds rate.

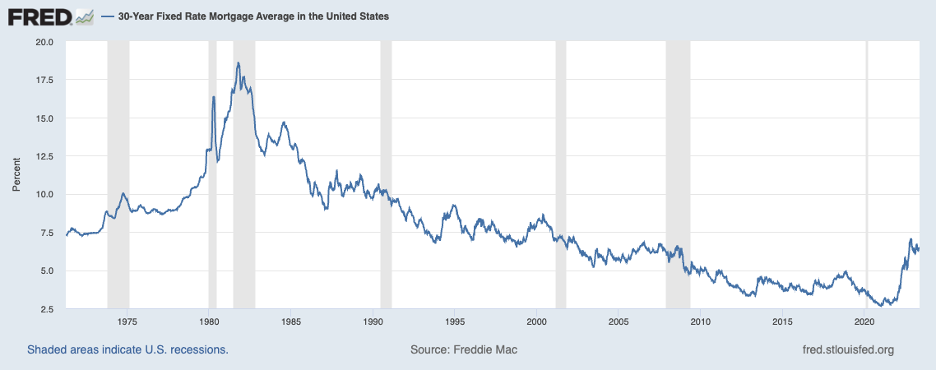

Its nature is to fluctuate — check the 30-Year Fixed Rate Mortgage Average graph below from the Federal Reserve Bank of St. Louis as an example — but traditionally, it dips during a recession.

How interest rates affect savers

Are you the type of person who loves to save every extra penny? Rising interest rates can benefit you. When interest rates go up, banks like ours often offer higher returns on savings accounts and other investments. Higher returns mean you get more back from your deposits when they stay put. The takeaway: periods of a higher interest rate can be a good time to save.

How interest rates affect investors

Most investors (at least the ones managing their own investments) track interest rate changes religiously, because they have a big impact on strategy. When interest rates are low, people often invest in options like stocks and real estate because they have higher return potential. When interest rates rise, investors may look to “safer” options, like bonds or certificates of deposit.

How closely to track interest rates

If you’re wondering whether this means you should be permanently glued to news from The Fed, the simple answer is: not unless you’re an economist, financial advisor, banker or heavy self-guided investor. Most of us can pay attention to the broader trends and turn to trusted advisors for deeper analysis.

Our community bankers are trained to be those trusted advisors, so if you have questions about long- or short-term financial goals and how current interest rates might affect your plans, we’ll give you honest feedback and expert guidance.

Just reach out to the Merchants & Marine Bank team online or stop by the bank location closest to you. We strive to help our Clients make the best financial decisions they can, whatever the interest rates outlook.